UK Government sets out EPR plan

The four UK governments have published their response to the Extended Producer Responsibility (EPR) for packaging consultation outlining the changes since the consultation and decisions taken forward. They have confirmed that EPR will be implemented in a phased manner from 2024, rather than 2023.

The new EPR approach was first proposed by the Department for Environment, Food & Rural Affairs (Defra) in 2018 to encourage the use of more sustainable packaging by charging producers to pay for the net cost of managing materials once they become waste. The new EPR scheme will be reviewed after two years.

IOM3 CEO Colin Church CEnv FIMMM, said, ‘Extended Producer Responsibility schemes have the potential to move us towards a more circular economy, reducing the impacts of material extraction and use on the environment. The news that the UK is continuing to move forward on this for packaging is therefore welcome. However, there is much still to do for this scheme to be effective and even with the delay to 2024 there is no time to waste.’

Jude Allan MIMMM, Chair of the IOM3 Packaging Group, adds, 'It is good to finally be in a postion of starting to think about moving forward with the implementation of EPR after all the consultations. Our challenge is to support our members as they take on the challenge of implementing EPR, making it accessible and understandable for everyone involved in packaging. The timings are still very tight and there are a number of details to be clarified, we want to be there to support our members as they get to grips with the implementation of this scheme in order to make it as effective and successful as possible.'

Changes since the consultation include:

- Payments – for household packaging waste and packaging in street bins managed by local authorities will be determined from 1 April 2024

- Modulated fees – based on recyclability will be introduced from 2025, rather than 2024

- Litter – England and Northern Ireland will not introduce payments for packaging waste that is littered. Scotland and Wales are considering steps to obligate producers for these costs

- PRN – The current packaging waste recycling note (PRN) system will be retained as an interim solution for managing payments for non-household packaging waste. A consultation on reforming this system has been published.

- Business waste – payments for commercially collected packaging waste (from businesses and other organisations that pay for the collection of their waste) will be further explored with the help of an industry taskforce

- De minimis – the threshold for producer obligation will not be lowered but new reporting requirements will be introduced

- Compostable and biodegradable packaging – will be required to be labelled as ‘do not recycle’

- Scheme Administrator – to be classified as being within the public sector and will start to mobilise in 2023 and be fully operational by 2024

- Financial impacts – revised annual cost of £1.7bn down from £2.7bn for obligated producers

Decisions taken forward from the consultation include:

- Payments to local authorities and councils (local councils in Northern Ireland) for collection of household packaging waste, and on the go packaging disposed of in street bins

- Modulated fees to incentivise the use of recyclable packaging

- Mandatory takeback scheme for the collection and recycling of fibre-based composite cups (disposable coffee cups)

- Mandatory labelling of packaging for recyclability with a single labelling format

- Enhanced waste sampling

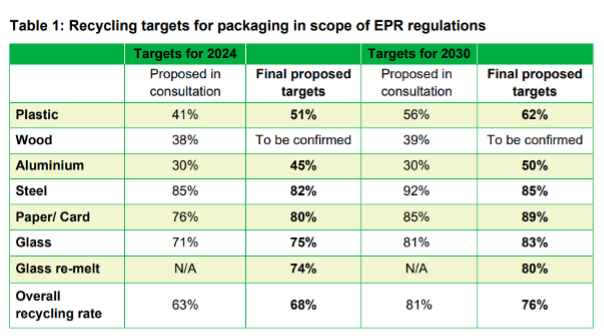

- Annual packaging waste recycling targets to 2030

While the Government response to the Deposit Return Schemes in England, Wales and Northern Ireland consultation has not yet been published, key decisions announced in the EPR response include:

- All-in DRS for beverage containers from 50ml to 3l will apply in England, Wales and Northern Ireland, aligning with Scotland.

- Wales DRS will include glass

- England and Northern Ireland will not include glass. Glass drinks bottles will therefore be in scope of EPR

Meanwhile, the Plastic Packaging Tax by HMRC will come into force on 1 April 2022 and will be charged at a rate of £200 per tonne, where the plastic used in its manufacture is less than 30% recycled.

You can find a response to the EPR consultation below:

For the full summary of responses and government response, visit bit.ly/3qLXl04

For more information on the UK Plastic Tax and how it might affect you, visit bit.ly/3iS8Leh