Mining the 'Climate Crisis'

James McFarlane FIMMM, General Manager – EMEA for Mining Plus, discusses how firm geological understanding and growing the mining workforce are critical to resolving the ‘Climate Crisis’.

Over the last few decades, mankind has identified that its actions through industrial development can have an impact on the Earth’s climate. While there are differing views on the level of impact this is having, what has more recently been termed as the ‘Climate Crisis’ is now widely accepted publicly, and perhaps, more importantly politically, as one of, if not the, most serious challenge facing the world today.

However, the world has not just stood still, and with carbon dioxide now squarely placed as the villain in the piece, the proposed solution widely championed is ‘net-zero’ i.e. ceasing the emissions of CO₂ to prevent further impacts on the Earth’s climate, and, if possible, reverse some of the damage already done.

Governments globally have set aggressive deadlines for net-zero to be achieved, with the UK targeting 2050 and the majority of other countries across the world targeting at least 2070. To date, the only countries that have achieved this critical milestone are Bhutan, Comoros, Gabon, Guyana, Madagascar, Niue, Panama and Suriname, according to the World Economic Forum.

While the actions of these nations should be applauded, they represent what was only a very small component of global carbon emissions. Therefore, the actions of these smaller nations is dwarfed by the more populous nations such as China and India, where there is clearly still a lot of work to do to meet their targets.

There are also moralistic challenges in motivating developing nations to not take advantage of cheaper, albeit ‘dirty’, energy to provide a better standard of living for their populace.

However, the targets have been set, and the world appears motivated, at least at face value, to meet them. Therefore to support this, a fundamental change – and equally a fundamental shift in the technology we use – is required. This ‘Green Transition’ is incredibly hungry for raw materials.

Precarious present

Recycling and a circular economy are championed by the target setters as being a key part of the solution, and while they may make better use of materials currently in circulation, there is a colossal shortfall that can only be filled by the generation of additional raw materials, which inevitably means that to achieve this, we need a lot more mines.

As a member of IOM3 reading Materials World, this is unlikely to come as a major shock to you, but the average citizen of the UK, sitting in their home built of quarried products, watching their TV or their smart phone, with their new electric vehicle (EV) on the drive is, very unfortunately, likely to have little to no comprehension of how their essentials for everyday life are sourced, which presents challenges in achieving what we need to do.

So, we mine more and everything will be ok? Unfortunately, it is far from that simple, as illustrated by the work of Dr Simon Michaux at the Geological Survey of Finland (GTK).

He says, 'The task to phase out fossil fuels is now at hand and is much larger than current policy planners appreciate.

The number of vehicles in the existing global transport fleet – 98.8% of which are still petroleum-driven internal combustion engine (ICE) technologies – is approximately 1.4 billion. The plan to phase out these ICE vehicles and replace them with EVs and hydrogen fuel-cell vehicles, and support these technologies with electrical power generated by wind turbines and solar panels, is faced with logistical impracticalities.

'The estimated sum total of extra, annual, non-fossil-fuel power generation capacity to phase out fossil fuels completely, and maintain the existing industrial ecosystem, at a global scale is 37,289.7TWh. If a non-fossil-fuel energy mix is used to achieve this (based on an International Energy Agency prediction for 2050), then this translates into an extra 607,052 new non-fossil-fuel power plants that will be required.'

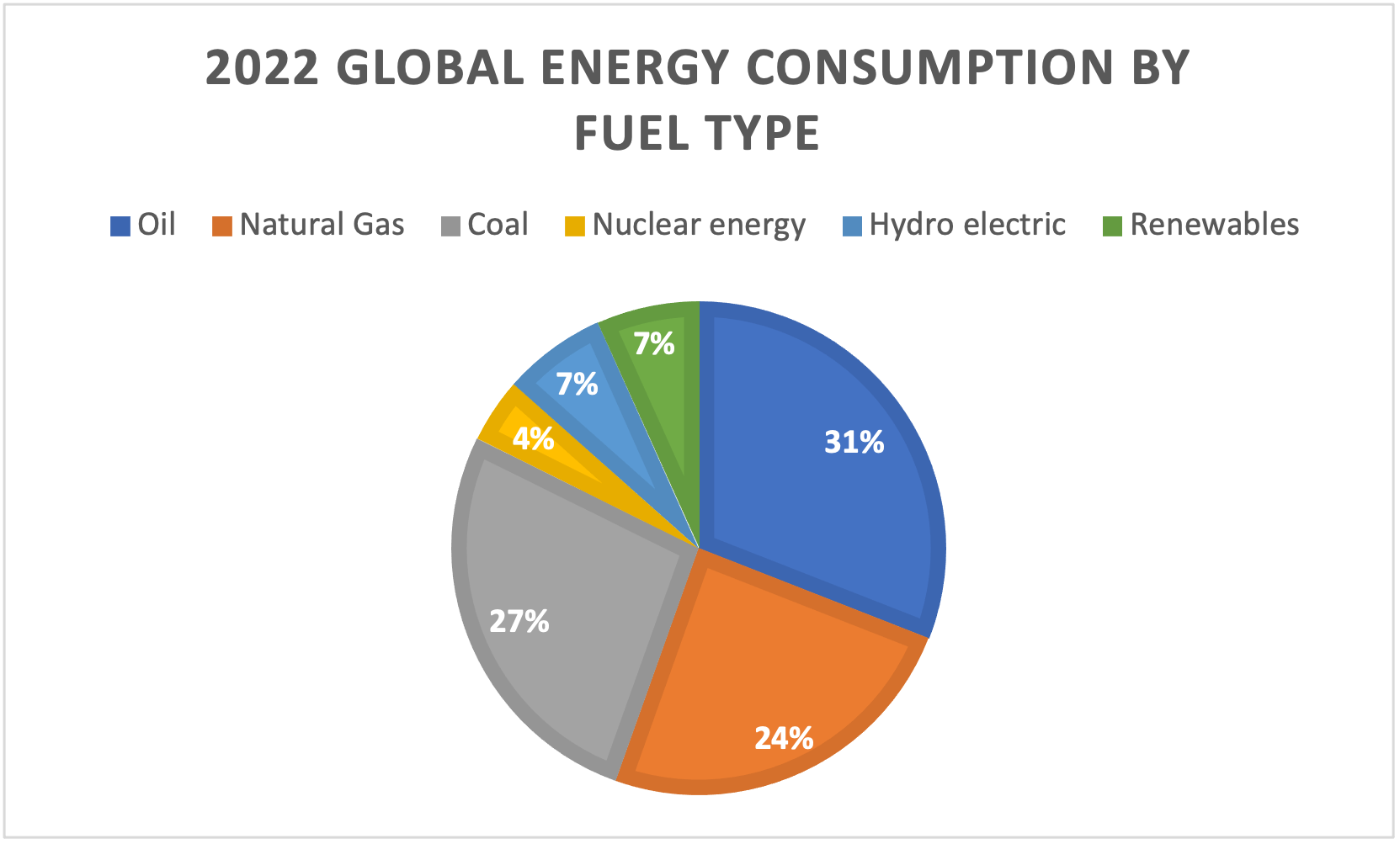

That is a significant additional power requirement, which is put into context when we look at the current breakdown of how the world achieves its energy, as published in 2022 by the Energy Institute (see pie chart below). However, the challenge ahead is more complicated than power generation alone.

Michaux elaborates, 'There are multiple parts of the Green Transition plan that have not been thought through. An example of this is the required stationary power storage to buffer intermittent electricity supply from wind turbine or photovoltaic solar panel power stations. This buffer is much larger than conventional thinking allows for, and the technology to store such a large quantity of electricity for several months does not yet exist.

'To mitigate the supply issues caused by the intermittency of wind-and-solar generated power for just four weeks of production, global stationary power storage would require an estimated 2,192.9TWh in capacity (or 17 million 100MW/129MWh capacity power storage stations). Until this is resolved, it may be that existing wind and solar power generation systems cannot be scaled up as planned.'

Power supply and storage is still only a part of the entire picture. Upscaling the supply of the other relatively new technologies, such as batteries, that are currently only being produced on a small scale in such a short timeframe (20 to 30 years) requires similar investment in smelting, refining, component manufacture and the manufacture of finished goods. For the Green Transition to happen at all, a major step-change expansion of industrial capacity is required to be constructed and commissioned.

Michaux continues, '[Moreover], a limiting practicality, which has the potential to make the whole plan unviable, is the supply of the required quantities of metals. The types of metals needed – lithium, cobalt, rare-earth elements, etc. – are considered relatively exotic in the current market. As such, these metals are mined now but in relatively small annual quantities, whereas the quantities needed for the Green Transition are enormous, and require mining rates equivalent or much larger than current copper production.'

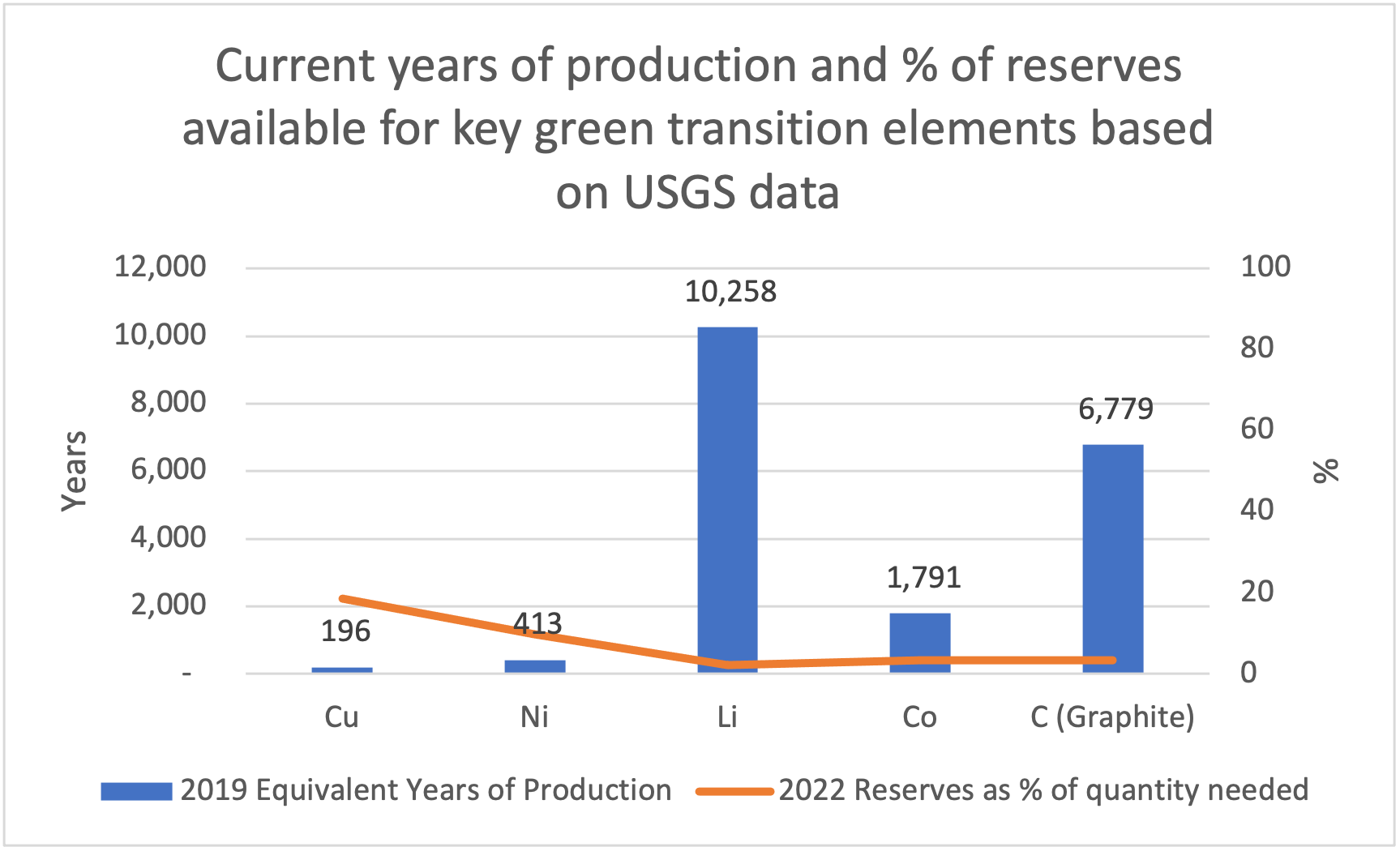

He uses recent global mineral statistics from the United States Geological Survey (USGS) to illustrate the scale of the issue (see graph below). This shows that if 2019 mine production figures are used, it will take between 196 years for copper and 10,258 years for lithium to deliver the quantities of metals required. However, production can be increased, assuming enough metals exist to be extracted.

If the USGS-reported mineral reserves in 2022 were compared against the estimated quantity of metals required to completely phase out fossil fuels, then we only have 19% of the required copper and just 2% of the required lithium available.

Time to mine

Regardless of your view on the Climate Crisis or the mining industry’s ability to meet material demands, the next few decades are likely to be a very challenging time for the industry as we address the quantum jump of moving from a fuel- to a metals-based energy system.

Forecasts across the raw materials space are showing increased demand, and yet the majority of mines are becoming increasingly marginal, have more complex metallurgy, in ore bodies that are more challenging to mine, with a lack of exploration investment in recent decades compounding the issue further.

These factors will no doubt be in some way mitigated by higher metal prices that a basic supply/demand model would predict, but there are additional challenges that money cannot fix, including the fact that the overwhelming pot of cash available to be deployed on mining projects now comes with strict environmental, social, and governance (ESG) requirements, and rightly so.

However, some projects, for better or worse, will struggle to meet these requirements, in particular due to jurisdictional challenges – you cannot move an orebody. While some parts of the world, regardless of their mineral wealth, are now off limits to these funds for geopolitical reasons.

Further, recent global events such as the Coronavirus pandemic and the invasion of Ukraine have re-aligned the rhetoric on security of supply, with many countries, the UK included, driving forward their critical minerals policies as a result, further limiting the sources available to meet demand.

As such, it may be expected that governments around the world are keen to engage with those who are at the proverbial frontline of the battle for these crucial minerals – the miners themselves. However, when Glencore CEO Gary Nagle was asked 'Have national governments engaged with miners in relation to their supply of critical minerals?' during his keynote address at the Melbourne Mining Club Dinner in London this July, his answer was 'No'.

This begs the question that if governments are not engaging with the worlds’ major suppliers of the minerals required for the Green Transition, then it is difficult to imagine the support will be there to achieve the output their policies demand.

Tackling this issue is the Critical Minerals Association (CMA), which was created to provide a platform for companies to come together and share key insights with the UK Government – the success of which has now spawned sister organisations in Australia and the US. Co-founder Jeff Townsend has been heavily involved in bridging the gap between the government and industry over recent years and provides cognisant insight into the challenges faced.

He says, 'Governments are notoriously slow to change direction. From multiple competing political agendas, to competing departmental goals, introducing proactive policy agendas is tricky and takes time. Significant new policy creation, due diligence, implementation and subsequent adjustments can, and often do, take over seven years. This is why we very rarely see radical new agendas unless a government knows it has two election cycles to deliver.

'The UK Government was hesitant to realise the potential critical minerals threat it faced. This is not hard to understand when you consider that the golden relationship between the UK and China was at its peak in 2016-17. In only three years, the government went from driving greater integration of China into the UK economy to recognising that there may be a critical minerals supply chain problem.'

A further three years on, and the UK Government has introduced a Critical Minerals Strategy that it has also refreshed. Strategic reviews also explicitly mentioned critical minerals – the Net Zero Strategy and a number of funding streams such as the Automotive Transformation Fund. Politically, this is significant progress being made at significant speed. But, while the UK Government has moved forwards two steps, the rest of the world has moved forwards three or four. The big difference is not the policy, it is the funding of the policy and this is where significant work needs to be done.'

Townsend adds, 'The UK Government is inherently free market and believes that market forces will prevail. Sadly, critical minerals are named as such because of market failure, otherwise they would just be minerals and materials. Other nations have recognised the threat and started to put significant state finance into rectifying the supply chain issues – the UK is yet to do so. State intervention is the new normal.'

Image problem

Whichever way you look at it, meeting the Green Transition’s requirements for materials is going to be a challenge of colossal proportions, and the mining industry will require significant support to achieve this. However, it has a significant image problem.

Anyone who has taken their children to see the gorillas at the zoo recently has no doubt been informed about how their biggest threat in extinction is mining (for Coltan). Yet the average UK citizen introduced earlier in this article has been perfectly comfortable ‘offshoring’ our material requirements for decades now, regardless of the consequences, and the thought of a mine in their back garden would likely make them baulk, despite any assurances of it being undertaken to the highest possible ESG standards.

The perception of dirty colliers disappearing down shafts below chimneys bellowing out smoke is unfortunately the mental legacy that most in the UK will think of, rather than the modern, safe and highly technical reality of the industry today.

Fundamentally, rather than being viewed as modern, safe and a critical part of the solution, mining is largely viewed as a major part of the problem due unfortunately to the legacy the industry has. This is most prevalently an issue with the younger, climate-conscious generations now embarking on study for their future careers.

With enrolment in geoscience and engineering subjects plummeting in recent years, this is compounding an already serious issue of finding enough people to sustain the current employment requirements of the industry, let alone one that has to step up a gear to meet the huge forecast demands of materials.

Did you know?

Mining-specific courses are in decline, with enrolment becoming extremely challenging due to public perception of the industry. A recent McKinsey survey of young people in the US and Canada reports that 70% of those surveyed either definitely or probably would not work in mining.

Source: Has mining lost its luster? Why talent is moving elsewhere and how to bring them back (2023), McKinsey

A sobering example much closer to home that illustrates this decline in industry-specific courses as a result of lower enrolments, has been the pausing of the Mining BEng at the prestigious Camborne School of Mines. This made headlines as a significant blow to the industry, and one that the subsequent Head of School, Professor Pat Foster, has worked tirelessly to reverse. One of the new initiatives to address the issue at hand is the introduction of a degree apprenticeship that commenced this September.

However, this is only part of the solution as Foster illustrates. 'A recent report by the UK Minerals Education Forum has estimated that at least 48 mining engineering and 18 mineral processing graduates are required per year just to sustain the UK mining industry.

'The degree apprenticeship will greatly assist mine operators address their shortfall in mine managers, but it will not address the requirements of the wider UK mining industry, for example in service companies, mineral processing or finance. Other than this, there is no real pathway for an 18-year-old school leaver to study mining unless they are employed by a mine operator who then puts them on this apprenticeship.

'Mining Engineering graduates are well received in the industry with excellent prospects, experience, responsibility and remuneration. With this in mind, it may be strange that we struggle to recruit young people into these courses and our industry today.'

Be the change

There are shoots of hope here, and several individuals and organisations are striving to bridge the gap and offer a more well-rounded view of how studying geoscience and engineering subjects can be a positive influence on the planet and our futures. Dr Natasha Dowey, Associate Professor in Sustainable Geoscience at Sheffield Hallam University, UK, is one such trailblazer, having created ‘Geoscience for the Future’ in 2020. The not-for-profit voluntary initiative aims to communicate the links between geoscience and a more sustainable future, and crucially to encourage the next generation of geoscientists.

Dowey has also been involved in collaborative research into perceptions of geology, which surveyed both geologists and non-geologists. The results of the new study – titled You just look at rocks, and have beards – are stark, and present a worrying outlook for future prospective university intake.

She reflects 'Our study reveals that long-held stereotypes of our subject – as old-fashioned, boring (a word used over 100 times in survey results) and detrimental to the environment – remain potentially damaging for future recruitment, and that even geologists themselves struggle to collectively define the holistic and critical role of our discipline in a better future. We propose that our community needs to be able to coherently and effectively describe what modern, interdisciplinary geology is, and to advocate for geology’s vital role in sustainable development.

'We need to make our subject more equitable and accessible to people from all backgrounds. At Geoscience for the Future, we highlight and showcase positive efforts in these areas – but so much more work is still needed. Industry is well placed to support and fund these efforts, and to promote the importance of geoscience education and improved public perceptions to policymakers, to secure a highly skilled talent pipeline into the future.'

As such a collective effort needs to be made, and IOM3 is playing its part here, having recently held discussions with representatives from industry and academia to discuss the critical skills required and what the Institute can do to help.

However, without a rapid shift in people’s perception of the importance of the mining industry in resolving the ‘Climate Crisis’, a hidden crisis continues to lurk behind the scenes.

Can the mining industry step up to save the world? With the right support and skills, it certainly has the potential to do so.

Also see last issue’s article on the IOM3 report, The talent gap – critical skills for critical materials.