Making more of manufacturing

Make UK says British manufacturers are pausing recruitment and investment amid rising employment and business costs.

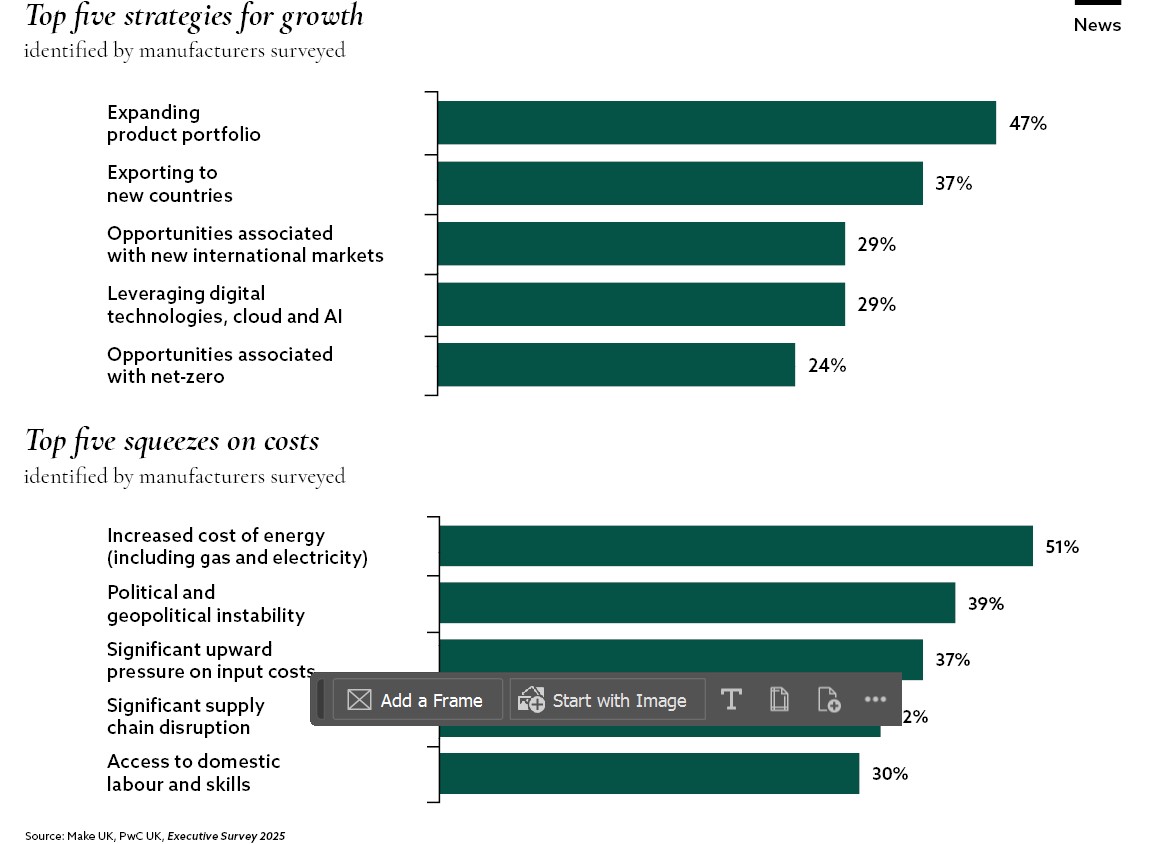

Britain’s manufacturers have high hopes that the government’s long-awaited Industrial Strategy will help them increase investment, boost productivity and secure the skills they need for the future, according to trade body Make UK and PwC UK’s Executive Survey 2025.

More than 150 senior executives in manufacturing firms were surveyed on the opportunities, risks and challenges facing them in 2025. But they are cautiously optimistic, says Verity Davidge, Director of Policy at Make UK.

Its more recent Q1 2025 Manufacturing Outlook highlights, 'The impact of persistently weak domestic order books, now combined with a sharp slow-down in exports and the shock of the Autumn Budget announcements, has resulted in every core metric either contracting or slowing down.'

The report reveals that the final quarter slump in business confidence in 2024, the fastest rate of decline since the pandemic, has now translated into a fall in both output and orders in Q1 2025. The latest balance of output is reported at -1%, down from +20% over the last three months. It is the first time in a decade that output has fallen in the first quarter of the year, as both domestic and export orders have slowed.

In response, half of the 300-plus companies surveyed have frozen recruitment, with over a quarter considering redundancies. A third of companies have also delayed investment plans.

These factors have led Make UK’s economics team to downgrade manufacturing sector growth forecasts for this year, with an expected contraction of -0.5% in 2025, down from the previous forecast of -0.2% in the last quarter, before growing by 1% in 2026.

A tidal wave

The 30 October Autumn 2024 Budget brought increases from April this year to the National Minimum and Living Wages and employers’ National Insurance Contributions (NICs) and Employment Allowance.

Unsurprisingly, 92% of the manufacturers surveyed off the back of it expected employment costs to rise further.

Davidge explains, 'Not many manufacturers have to change their baseline pay in order to meet the national living wage requirements. But because of how manufacturing job roles are essentially graded, it is the knock-on impact of maintaining pay differentials. It is the need to then increase supervisor pay and managerial pay and then direct level pay, and actually all of that together essentially increases your pay bill.'

She notes many companies continue to pay a premium on engineering roles to retain staff as talent is in high demand. Make UK reports that the manufacturing sector as a whole paid 9% higher wages than the economy average in 2024.

The Autumn Budget also announced the Employment Rights Bill. Davidge reflects great concern among manufacturers that provisions like the right to statutory sick pay from day one will add a cost to business. 'It is that accumulation effect, that all of these things together is just going to hype [up costs] for this year.'

They are concerned about rising employment costs, energy costs and business rates at 'four-times the average compared to any other sector'. In fact, half of respondents want reform of the business rates system.

'It is just the tidal wave of costs hitting business, so how do you offset those costs elsewhere,' she notes.

Sixty-nine per cent of those surveyed said they intend to pass on increased costs to their customers. The knock-on impact on investment plans has already filtered through in the first quarter of this year.

However, Make UK 'would expect to see an improvement in the sector’s view of supply chain reliability as, relatively speaking, the past six to 12 months have seen the most consistent manufacturing business environment relative to any of the preceding five years (Brexit, COVID-19, energy crisis, etc)'.

Davidge also points to the resilience of the manufacturing sector, as the pandemic forced many companies to secure their supply chains and build in greater reliability.

Nevertheless, 'policy uncertainty remains exceptionally high, with the greatest immediate threat to supply chain viability arising from potential US tariffs across greater swathes of UK and/or EU goods.'

Creative thinking

On the positive, the energy crisis did force companies to be more creative in reducing consumption and becoming more energy efficient, points out Davidge. Obviously, this all helps with the energy transition.

'Electrification is [also] possible from a technological standpoint for up to 75% of industrial processes, today,' Davidge says. 'What is inhibiting electrification, however, is the comparatively high cost of electricity when put alongside gas (UK) and international competitor electricity market prices.'

Davidge says the focus on environmental, social and governance (ESG) issues depends on the company size and sector. For example, defence procurement contracts are required to focus on social values.

She flags that many companies are focusing on net-zero targets and looking at their Scope 1 and 2 emissions accordingly, potentially Scope 3. However, more work is needed to map out key milestones for the manufacturing sector.

The Net-Zero Council, set up under the last government, is being continued, and Davidge notes the partnership includes more unions under the Labour Government. 'Some of those conversations have been, ‘can we create sub-sector roadmaps for net-zero down to ceramic level because it is needed?’ But it is pretty challenging.'

However, over the last year, 'I think you get to a point where the focus is keeping afloat. And I think we’re slightly at risk of being in that territory as a sector.” There are more “concerns around cost and compliance for the next six to 12 months.'

Eyes peeled

Manufacturers are now on the look-out for Invest 2035: The UK’s Modern Industrial Strategy, to offer certainty and stability.

More than half of those surveyed agreed that the strategy will increase their plans for investment. While 68% of respondents would be keen to focus on productivity, 46% identified energy efficiency.

And there is a stronger focus on increasing investment in automation. However, the installation costs, maintenance and repair costs are a big outlay for SMEs especially.

Davidge comments that larger companies are twice as likely to be adopting artificial intelligence and machine learning on the factory floor, with the understanding of how to get a return on their investment quickly. SMEs need support to maximise the capabilities.

The challenge is that raw materials are still expensive, and haven’t returned to pre-pandemic, pre-Brexit levels.

For the Industrial Strategy, Davidge says the government has picked broad winners, as it will focus on eight growth-driving sectors – advanced manufacturing, clean energy industries, creative industries, defence, digital and technologies, financial services, life sciences, professional and business services.

Make UK’s response to the government’s green paper on the strategy highlighted that more attention needs to be paid to the Foundation Industries of cement, metals, glass, paper, ceramics and chemicals.

She concludes, 'How do you take industrial strategies and net-zero stuff, defence, trade strategy and pull everything together so that it makes sense of what we actually want to achieve as a nation?'