In the can? Making aluminium more sustainable

Dr Michael Kenyon MIMMM, Rachel Wiffin MIMMM and Dr Geoff Scamans FIMMM, at Innoval Technology Limited, UK, propose a blueprint for 'greener' aluminium.

Aluminium is the second most widely used metallic system globally after iron and steel, with around 100Mt of material produced annually. The use of aluminium has only increased over the previous few decades and is forecast to grow through to 2050, with the automotive, packaging, construction and energy transition industries the main consumers.

However, like every other material system, sustainability is at the forefront of public and governmental policies. With COP26 having been and gone, it is up to industry and governments to implement green strategies and new technologies to achieve the emission reductions necessary to keep global warming to below 2°C (versus pre-industrial levels) as a minimum, and ideally below 1.5°C.

The global aluminium sector accounts for around 2-3% of greenhouse gas (GHG) emissions, and therefore has a responsibility to help tackle climate change. The UK does not have as large an aluminium industry as some of its EU and global counterparts, but there are significant opportunities to revitalise this sector and, most importantly, contribute to reducing the global carbon footprint of the aluminium industry.

In 2018, a total of 51Bt CO₂e was emitted. Of this, 1.1Bt was emitted by the aluminium sector for a total production of 95Mt of aluminium – 66% of this was produced from a primary source and 34% from a secondary source, such as recycling of pre- and post-consumer scrap. The majority (~95%) of the 1.1Bt CO₂e contribution occurs from the primary production of aluminium.

There are four major stages to producing pure aluminium – raw extraction of bauxite ore, which has a high content of aluminium in the form of an oxide called alumina; bauxite refining to alumina; alumina reduction to liquid aluminium via smelting (electrolysis); and finally casting of the liquid aluminium into ingot or other form.

There are emissions related to all four process steps, however, it is the large quantity of electrical power required for the smelting stage that contributes the most to emissions. Recently, the electrical energy has predominantly been obtained from non-renewable sources e.g. coal or natural gas based power stations.

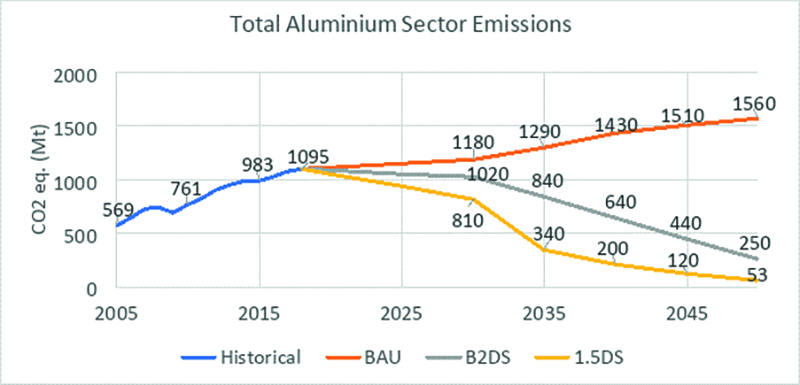

The International Aluminium Institute (IAI) has modelled the GHG reductions necessary across the supply chain, including primary production, secondary production and semi-fabrication. The total sector emissions ‘allowed’ under the two global targets are shown in the figure below.

The total sector emissions need to reduce by 77% by 2050 to achieve the 2°C target, known as the Beyond 2 Degrees Scenario (B2DS), which aims to limit global temperature rise to less than 2°C above pre-industrial levels. This is in combination with a forecast growth of 80% in the global aluminium market, from 95Mt in 2018 to 178Mt by 2050. This is a daunting target.

The process emissions can be further explored in terms of the two main manufacturing routes – primary and secondary production. Pre-consumer scrap – also known as fabrication, prompt or new scrap – is produced during component manufacture, such as off-cuts or machining scrap for example. Post-consumer – also known as end-of-life, obsolete or old scrap – is material that arises after the product has been used.

by 2050 © International Aluminium Institute

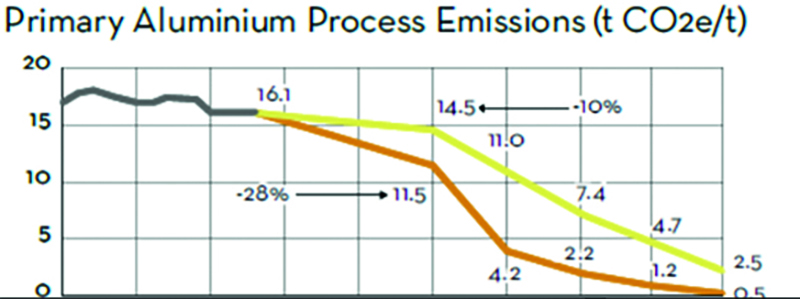

The figure above shows the emissions reduction required for the future production of primary aluminium to reach the required environmental targets by 2050, related to the production of a tonne of aluminium. Producing aluminium from secondary materials produces significantly lower emissions and only requires a fraction of the energy compared to primary production in the current market.

The aluminium industry can achieve this through three main pathways – electricity decarbonisation, direct process emissions reduction and recycling of secondary material. The solution that can be implemented the quickest is recycling of secondary material.

The production of pre-consumer secondary material is currently unavoidable. However, as it is of the same specification as the component, it is relatively easy to recycle back upstream and is generally achieved through supply chain relationships.

It should go without saying that this secondary source should be exploited as much as possible. Ideally, in the future, material usage rates should be improved to reduce the production of pre-consumer secondary material.

The most effective solution the aluminium sector needs to implement is increasing the use of end-of-life secondary materials, and this is where the UK has a significant opportunity.

Securing our scrap

The UK imports almost all its aluminium, and exports the majority of both its prompt scrap from industrial processing and its end-of-life scrap as there is very little remaining capacity for either sheet or foil rolling, or for extrusion for automotive applications like battery enclosures or crash management applications.

This means that even when rolling blocks are cast in the UK using either press-shop scrap for automotive alloys, or a combination of recycled used beverage cans (UBCs) and skeletons from the can-makers, they are exported for rolling and finishing in Germany or Switzerland to provide the aluminium automotive body sheet or can body sheet for the next generations of these products. It is estimated that more than a million tonnes of this low-carbon aluminium resource leaves the UK this way every year.

The present demand for end-of-life aluminium scrap in the UK is relatively low and so most of this scrap is exported usually as a mixed un-sorted recyclate mainly from end-of-life shredded vehicles or demolished buildings. The only way to change this situation is to invest in new casting, rolling and extrusion infrastructure, and in the advanced scrap processing and sorting technology that is now available as an alternative to either hand-sorting or dense-media separation that has been used in the past. The payback period for such investments is short.

It has already been established that automotive and can body sheet alloys can be formulated from 100% end-of-life scrap if they are effectively sorted using X-ray transmission-based techniques, which separate scrap streams based on density measurement, integrated with colour and shape recognition for example. UK Research and Innovation, via Innovate UK and the Knowledge Transfer Network, together with the UK’s Advanced Propulsion Centre, have supported several projects through their collaborative R&D competitions to demonstrate that low-carbon, scrap-based, wrought aluminium automotive alloys can be directly substituted for the prime incumbents.

The demand for these major local supply chain changes is coming both from the major global packaging and automotive brands operating in the UK market, noting that their promised sustainability targets can only be reached by moving from primary to end-of-life based aluminium feedstocks to meet their mandated low-embodied carbon requirements.

The latest information from the IAI on aluminium can recycling has shown that the global average recycling rate is 71% on average. This situation needs to change through a fair deposit return scheme (DRS) in the UK and the introduction of effective extended producer responsibility (EPR) legislation.

This is happening very slowly in the UK where the devolved administrations are continuing to work with industry groups to explore payment options for commercially-collected packaging waste to inform a review of EPR in 2026/27. This seems both tortuous and slow as worldwide there is a strong correlation between effective DRS schemes and the recovery of UBCs.

The global average recycling rate of aluminium is 71%. Only one in three cans returns as new can body sheet. One is returned in a different product, usually a shape casting, and one is lost to landfill or incineration.

Today, more than 20Mt of post-consumer aluminium scrap is recycled globally each year derived mainly from vehicles (32%), packaging (27%), buildings (16%) and other products (25%).

High-level recycling

Today, more than 20Mt of post-consumer aluminium scrap is recycled globally each year derived mainly from vehicles (32%), packaging (27%), buildings (16%) and other products (25%). About 6Mt of wrought post-consumer aluminium scrap, made up of 4Mt of rolled and 2Mt of extruded, end up in castings. About 7Mt of aluminium is lost from the primary and secondary global supply chain every year.

Aluminium is particularly suited for high-level recycling that is sometimes termed ‘upcycling’, where the end-of-life scrap returns at the same or higher use level. Wrought aluminium alloys like AA3105 for can body sheet, and high strength and high crush resistant AlMgSiCu AA6xxx alloys for automotive body sheet, are tolerant of impurities like iron and copper.

Now that it has been repeatedly shown that wrought and cast alloys can be effectively separated at low cost using automated sorting techniques like X-ray transmission, the door is wide open for switching the UK from a scrap exporting country to one where this scrap is valued as a low-embedded-carbon resource to make sheet products for the 18 billion beverage cans made in the UK each year, and to make the sheet and extruded products for battery electric vehicles and delivery vehicles.

Aluminium suitable for secondary casting alloy production would also be available from the Zorba fraction derived from shredded end-of-life cars, as castings remain the dominant form in this scrap stream.

Presently, recycled aluminium scrap has an embedded carbon content based on the source of energy used for melting and this is usually quoted at 0.6t CO₂e/t of aluminium if the scrap is melted using propane-fired burners. This would be reduced significantly if melting was achieved using electric-based induction on renewable electricity, or using oxyfuel or oxyfuel mixed with green hydrogen. These are the pathways to reduce the embedded carbon in recycled end-of-life aluminium down to 0.1t CO₂e/t of aluminium within a relatively short timeframe. Decarbonisation of recycled aluminium is much simpler and much more straightforward than the decarbonisation of primary aluminium.

Recycling end-of-life aluminium could have a larger impact on global warming than switching to inert anodes for primary production at a much lower cost and in a much shorter time frame.

Well positioned

As apparent from last year’s COP26, the largest regional emitters of greenhouse gases do not give the world hope that the necessary emissions reductions will be achieved from government interventions.

The UK has an opportunity to lead the way in switching from a prime-aluminium-dominated industry to one based on high-level post-consumer scrap recycling. This will directly support the expanding use of aluminium in transport applications that decrease emissions, or packaging applications that reduce environmental impact.

Recycling end-of-life secondary materials is one of the key solutions the global aluminium sector needs to implement to move towards achieving the targets set out above. The UK could invest in new scrap processing and remelt facilities and use the large quantities of end-of-life secondary material it currently produces annually.

Roll ahead

The time is right for UK investment in manufacturing facilities for both sheet and extrusion to support the growing demand for both beverage cans and the battery electric vehicles (BEVs) required by the UK OEMs to satisfy both their legislated carbon targets and for increased local content. This demand makes a compelling case for a new UK aluminium sheet rolling facility directly supplied from low-carbon end-of-life scrap with both renewable electricity and green hydrogen on tap.

The UK demand for high-performance aluminium automotive extrusions is also growing. These high-performance extruded sections are presently imported and made from primary aluminium and prompt scrap. These requirements could be met by upcycled, end-of-life aluminium, provided that the necessary sortation technology is used.

Our recent life cycle assessment studies have shown that, for alloys formulated from end-of-life scrap, the embedded carbon could get close to net-zero using

wind-generated electricity and either electric heating or green hydrogen.

The UK aluminium industry no longer has industrially funded corporate research centres but is supported by research groups, for example the EPSRC-supported Future LIME Hub at the Brunel Centre for Advanced Solidification Technology (BCAST). However, unlike other foundation industries, it does not have a sustainability centre like the recently founded Glass Futures.

Aluminium manufacturing technology is not directly part of the seven High Value Manufacturing Catapult Centres and, although Innoval Technology provides UK technical support, it does not have the scale of equipment required for piloting and demonstration. The situation for aluminium extrusion is slightly better with the

full-scale extrusion press at BCAST on the Brunel University campus.

The UK presently has no aluminium pilot rolling facility at a scale that is a suitable for direct technology transfer to industrial practice. This means that there is a strong case for a Sustain Aluminium Centre with the mission to make aluminium the low-carbon material of choice.