Headline statistics released for UK PPT, revenue down

The Plastic Packaging Tax (PPT) statistics cover receipts collected by HM Revenue and Customs (HMRC) in the financial year 2023-24.

The amount totalled £268mln, decreasing by 6% compared to 2022-23.

On 24 July 2024, there were 4,669 businesses registered to the PPT.

According to the statistics, of the total tonnage of plastic packaging manufactured in and imported into the UK, 42% was declared as taxable under PPT.

Taking the remaining 58% of plastic packaging tonnage manufactured in and imported into the UK, 46% contained 30% or more recycled plastic, 11% was either exported, intended for export or converted, and less than 1% was exempt because it was used for the immediate packaging of human medicines.

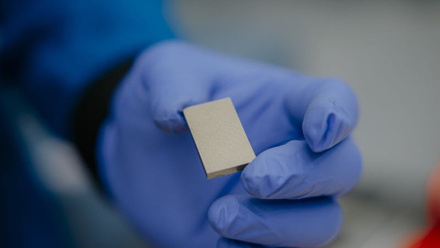

The tax applies to manufacturers and importers of plastic packaging components which contain less than 30% recycled plastic.

Manufacturers and importers declare their plastic packaging on fixed quarterly accounting periods, ending in June, September, December and March.