Relying less on China's copper supply delays energy transition, says report

Wood Mackenzie reveals that relying less on China’s critical mineral supply chain would require US$85bln in investment.

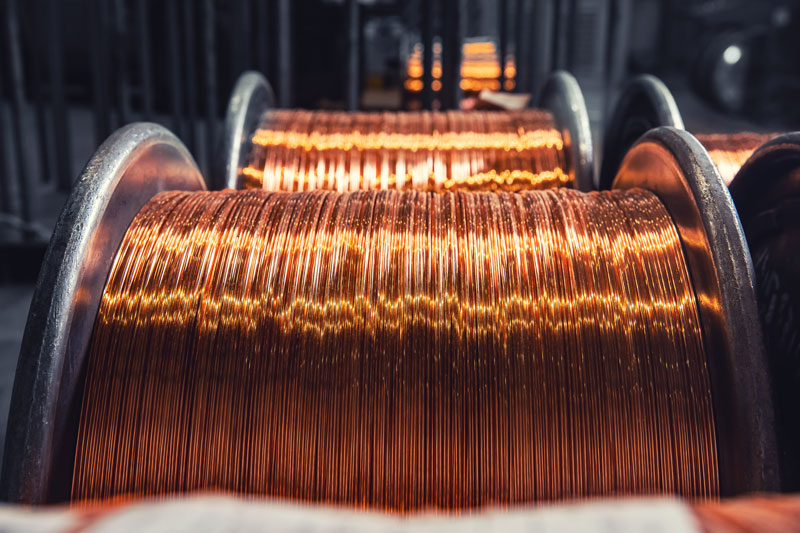

Copper is crucial to electrification. There are four stages to the global copper supply chain: mining, smelting and refining, semi-fabricating and manufacturing.

China dominates copper mining, downstream processing (smelting and refining) and semi-manufacturing. The country contributes more than 3Mt of production and nearly US$25bln in investment to its smelting.

Nick Pickens, Research Director of Global Mining at Wood Mackenzie, looks at the whole picture when discussing decarbonisation.

‘Based on our projections, there will be an additional 8.6Mt of copper demand outside China over the next decade. This demand represents 70% of smelter capability and 55% of fabricator capacity in the rest of the world. As governments and manufacturers aim to diversify away from China, it is crucial to consider the entire supply chain, not just mining operations.’

Demand is expected to skyrocket further by 2050. The Securing copper supply: no China, no energy transition report says demand for copper is expected to rise by 75% to 56Mt by 2050.

The report claims regulations and cost hinder other countries processing capacity.

The EU’s Carbon Border Adjustment Mechanism imposes higher taxes on the copper industry without providing equivalent benefits. The US Inflation Reduction Act may not ensure the long-term sustainability of the domestic industry.

Although there are no plans for new primary smelting capacities in North America or Europe, there are some shifts in global smelting capacity.

India is launching a custom smelter, Indonesia is adding two integrated smelters, and a new smelter in the Democratic Republic of the Congo is expected to be completed by 2025 - primarily driven by Chinese investment.

According to Wood Mackenzie, these additions will add 1.6Mt to global smelting capacity, the largest increase outside China in decades.

Pickens suggests a solution to the geopolitical problems facing sustainability in copper. ‘Financing these investments presents additional hurdles, with resistance to new smelter projects on environmental and social grounds particularly strong in Europe.

‘Pragmatism and compromise will be essential to achieve net-zero goals without imposing excessive costs on taxpayers. Easing global trade restrictions could be one necessary concession.’

China, meanwhile, has undergone significant evolution of its smelter capacity over the last few decades and the report claims its capacity will grow.

Since 2000, China has 75% of global smelter capacity growth and currently controls 97% of global smelting and refining capacity.

The country has also added nearly 11Mt of copper and alloy capacity since 2019, representing around 80% of global additions.

Approximately two-thirds of these facilities produce wire rods, giving China half of the world’s fabrication capacity, with further expansion underway.

‘Today, Chinese smelters are low cost and meet high environmental standards, particularly in sulphur dioxide capture, making them highly competitive,’ summarises Zhifei Liu, Managing Consultant of Copper Markets.