A supply paradox - the sands of time

The contradictions at play in sand mining.

There is a spectre haunting the mining industry – the spectre of shortage.

A formerly shapeless phantom, the apparition is now coming into focus throughout the global industry. Indicative of this is high metal prices, a dearth of high-quality mineral deposits coming onstream, and downstream companies offering all the environmental, social and governance buzzwords on their social media while turning a blind eye to the real source of their nickel and cobalt.

In the original Karl Marx quote, the haunting of European governments by the spectre of Communism implied that, to those in power, the ideology had tremendous power itself. To acknowledge it, other than as an insulting label for your opposition, would be to admit to its troubling existence.

Jump forward 100 years to the current day, and another troubling existence is presenting itself to national governments. This is the shortage of mined raw materials at a time when demand is predicted to rise steadily into the foreseeable future.

If we look a little deeper, a strange paradox presents itself. Nowhere is the shortage felt more acutely than in the mining of a non-descript, low-value, granular material that exists almost everywhere on planet Earth. This is sand, and in particular silica sand.

Silica sand has been a vital resource since pre-historic times. It was initially used in construction and early glassmaking, then in the steel and glass industries of the Industrial Revolution. Today, it is used in glass, metal casting, oil and gas extraction, filtration, construction, sports and leisure facilities, as well as specialist industries creating solar cells, silicon chips, fibre optic cables, ceramics and specialist lenses.

Sand is the second-most used resource on Earth after water, according to the UN Environment Programme. Its Sand and Sustainability report reveals that around 50Bt is mined globally every year, increasing by 6% annually. This means that production will double every 13 years.

An equal amount of suitable resources needs to be found to replace the material mined. However, despite its abundance, there is increasingly little of it that is being identified as suitable for our industrial or commercial uses.

If we had a modern analogy of the Philosopher’s Stone, then perhaps silica sand would be it. Human ingenuity has enabled us to take an inert material found on every beach and transform it to create complex electronic devices, capable of supplying us with almost unlimited information and opportunity, while allowing us to communicate over unthinkable vast distances instantaneously.

Sand castles

Another paradoxical behaviour of silica sand is its value.

Most sands retail for less than US$50/t, and even high-purity silica sands of more than 99% silica sell for around US$20/t.

Meanwhile, specialist sands can be upwards of US$100/t, silicon retails at US$3,700/t, and electronic chips are more than US$200,000/t. Processing this extremely low-revenue material therefore creates tremendous added value, in some instances, more than 10,000 times the initial price.

It is common for a silica sand mine to have multiple product streams, ranging from very pure, high-value product to lower-value filter or construction sands.

As it is a bulk product, the transport costs are prohibitively high, meaning most sand products are sold locally. A local market is usually very keen to have a nearby producer who can provide them with a consistent, on-spec product for a reasonable price. This is especially the case inland, where access to cheap, long-distance freighting via seaports is not available.

The sand market is therefore very different from the global trade in many mined commodities, which are bought and sold based on a worldwide price irrespective of location. Understanding the local market becomes the most important constraint on developing a silica sand project. Developing a project through pre-feasibility and feasibility stages usually needs to have some sort of offtake agreement or memorandum of understanding signed before financing can be initiated.

Geometallurgical behaviour

The third paradox is sand’s unusual geometallurgical behaviour. There are multiple factors to consider when analysing silica sand and preparing it for market.

The most important is the content of deleterious components. This is a rogues’ gallery of chemical miscreants, including iron and titanium oxides, clay, organics and zircon.

Secondly, the grain size distribution plays an enormous role in profitability. Preferable grain size for melting is 150-600µm diameter grains, and the more angular the better. Because of the product’s low monetary value, crushing coarser grains to reach that size quickly becomes uneconomic.

This means that sands without a large proportion of grains in this range are therefore unlikely to be used in silica sand products. Coarser grains do not melt easily, nor are they useful in filters. Finer grains get affected by electrostatic forces and behave like clays and colloids, clogging up filters and furnace feeds.

Impurity content, the grain size and shape, and its amenability to improvement through washing and mechanical sorting, is far more important than silica purity.

Almost all silica sands are purified and processed by a combination of the same physical methods. Initial screening selects the required size fraction like a big sieve that removes the fine and coarse fractions.

Then comes attritioning, which you can think of as a big washing machine that agitates the sand fluidised in water and uses inter-grain attrition to clean the iron oxides and clay from the grain surfaces.

A combination of chemicals causes the clay and iron oxides to separate from the silica sand, and are removed along a waste pathway.

At this point, the silica sand goes through a combination of heavy liquid separation and/or magnetic separation. This removes the final denser or more magnetic contaminant grains, leaving a pure product with greater than 99.5% SiO2. Analysis of purity at this point defines the end use.

At all points in the process route, waste is created. Oversize grains, fine grains, iron and titanium oxide grains, alongisde clay waste, can be several weight percent of the total throughput. Oversize and fine materials can usually be repurposed and sold as a lower-value product.

Through the looking glass

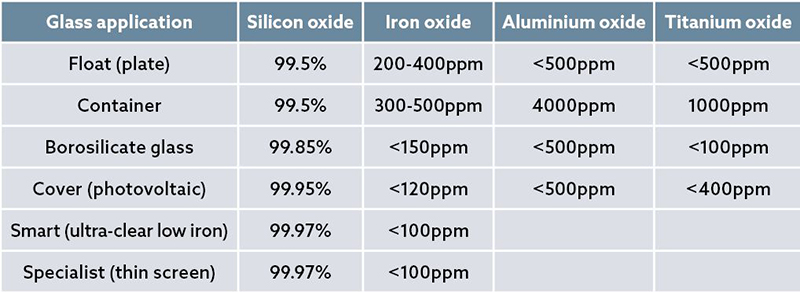

For glass applications, there are strict contaminant levels that must be adhered to. Iron content affects glass colour. More iron means more greenish tint. Aluminium, titanium and zirconium oxides cause problems with the melt and bubbles in the glass.

Sand pit

So why is there a shortage? Simply put, escalating global demand in the construction and technology sectors.

Urbanisation and infrastructure development in Asia and Africa are leading to an increasing demand for billions of bulk tonnes of sand each year, while the production of electronic consumer items relies on increasing volumes of high-purity silica for microchips and glass screens.

This is at a time when many countries are starting to bring in isolationist or resource-nationalist policies. These manifest in import/export restrictions and populist policy-based bans on mining. The effects of this are widespread and felt most among the poorest people of the world.

Construction and raw materials costs have also skyrocketed post-COVID, and because our semiconductor and electronics industry is precariously based on only a few, very high-purity silica mines, recent natural disasters have caused price increases and disrupted the semiconductor supply chain.

The most disturbing effect is the rise of illegal sand mining and the mixture of bribery, extortion and violence to control such activities. Excessive and unsustainable sand mining has led to river and ocean pollution, destruction of freshwater aquifers, increased flooding risks and displacement of population.

It is very difficult to get figures on the total amount of sand illegally mined, but some estimates put it at as high as 50% of sand on the global market.

Silica sand is also part of the resource ‘proxy wars’ across the African and Asian continents, with Western and Chinese companies vying for control of raw material assets.

Battle on the beach

This brings us back full circle to the ghost at the feast of European governments. In Europe and the Western world, we are in danger of getting left behind in the scramble for sand.

Years of poorly thought-out raw materials policy have left us in a situation where we are relying on smaller resources of high-quality silica, while having to heavily subsidise local, marginally profitable projects to secure supply.

This is likely to become exacerbated in the future. Malaysia and Indonesia have already banned sand exports, in a move likely to be copied by other countries looking to shore up their own supply.

Egypt produces about 35% of the world’s silica sand. They are starting to restrict exports in a push to see some added value. The Egyptians appear keen to have their own downstream industrial processes for sand and unlock value by selling silica end-products rather than the raw material.

This behaviour is sending the sand trade underground. Rather than properly incentivising, monitoring and policing sand mining – which could result in incredible development opportunities for some of the poorest people in the world – government action is fuelling illegal trade and allowing sustainable use to slip further from reality.

As with all raw materials supply issues, real sustainability requires global action. Politicians or leaders with integrity and technical knowledge can empower local governments and communities to use their resources in a way that will benefit them directly.

So what about the future? The positives are that human ingenuity always overcomes shortages. The UN has started to call for sand to be recognised as a strategic resource, with research into alternatives for construction sand starting to bring forward economic and sustainable recycled options like crushed rock and old building materials. The UN and World Economic Forum is seeking global collaboration.

As the price of mined raw materials continues to rise, this will precipitate confrontations around the world, empower criminal gangs and isolationist government regimes, and overwhelmingly affect those already living in poverty in the developing world. The war on sand is perhaps just beginning.